TaxSolver: A methodology to design optimal income tax reform

arXiv preprint (w. M. Schellekens and M. Garstka), 2025

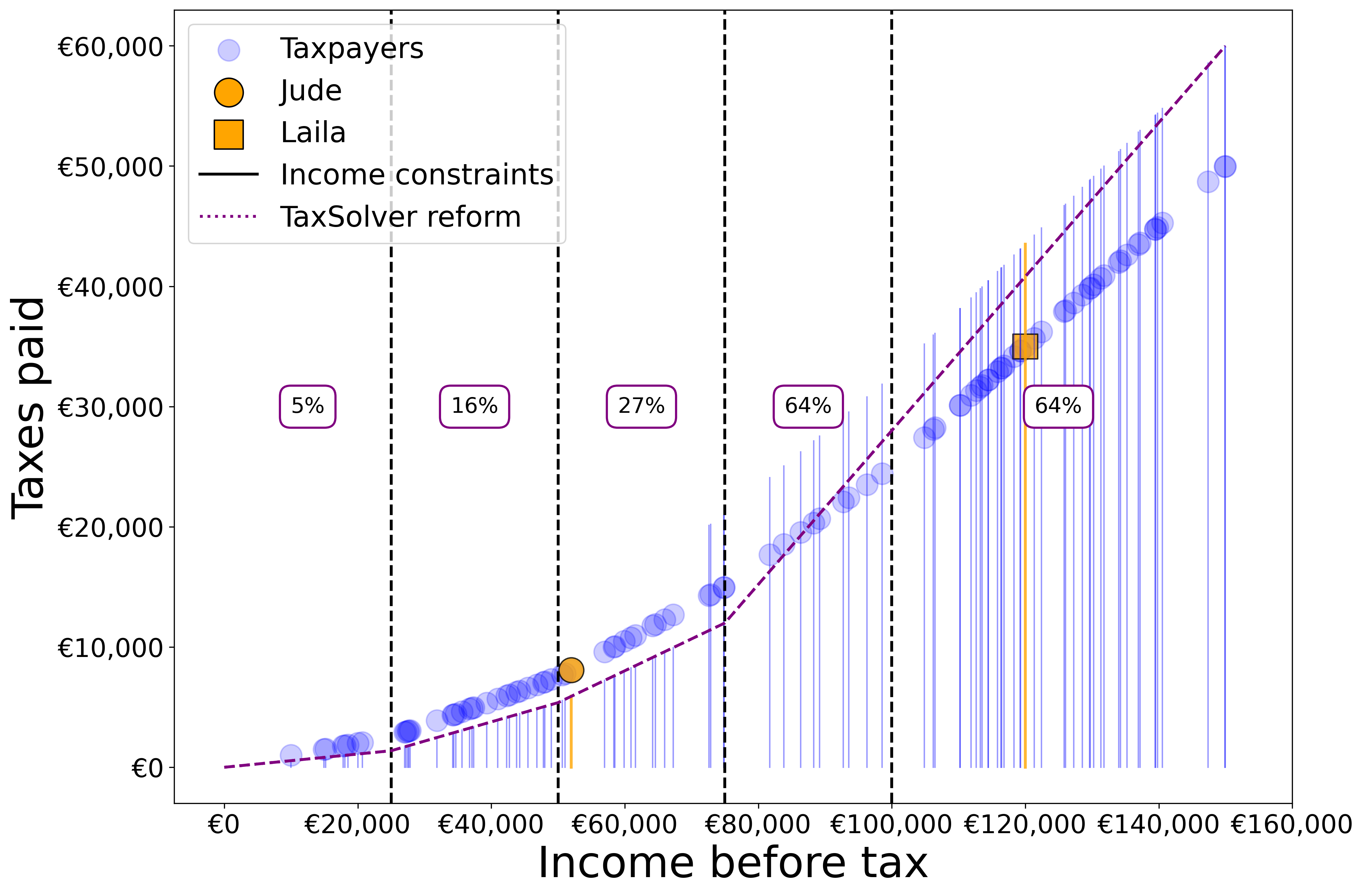

Across the developed world, there are growing calls to streamline and improve ever more complex income tax codes. Executing reform has proven difficult. Even when the desired outcomes of a reform are clear, the tools to design fitting reforms are lacking. To remedy this, we developed TaxSolver: a methodology to help policymakers realize optimal income tax reform. TaxSolver allows policymakers to focus solely on what they aim to achieve with a reform -- like redistributing wealth, incentivizing labor market participation or reducing complexity -- and the guarantees within which reform is acceptable -- like limiting fluctuations in taxpayer incomes, protecting households from falling into poverty or shocks to overall tax revenue. Given these goals and fiscal guarantees, TaxSolver finds the optimal set of tax rules that satisfies all the criteria or shows that the set of demands are not mathematically feasible. We illustrate TaxSolver by reforming various simulated examples of tax codes, including some that reflect the complexity and size of a real-world tax system.